HMRC Awakens…

It has been widely publicised that there was an initial reduction in HMRC compliance activity when the first lockdown commenced back in March. With HMRC in the same boat as most, adapting to working from home and unable to undertake face to face compliance work and given that politically it was not the time to actively pursue compliance, taxpayers were given extensions or compliance work was suspended.

What was clear was that this always represented the calm before the storm, that there would eventually be pressure on HMRC to generate tax yields in order to fund the enormous spending through this period, as well as a need to check that the measures put in place to support the economy had not been abused.

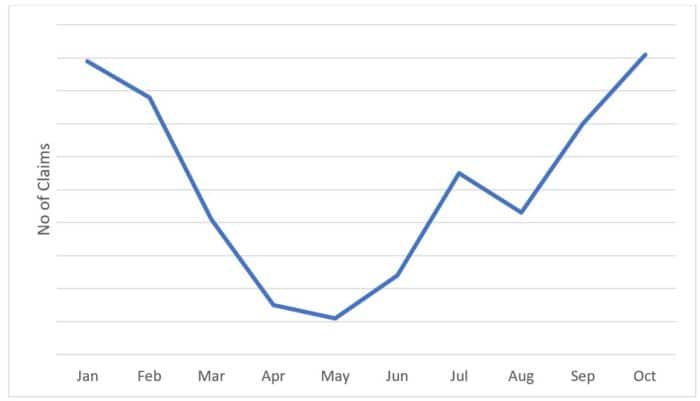

As a Fee Protection Insurance provider we have seen this play out in recent months, with the number of claims increasing quickly since May and now exceeding pre-covid levels.

The increase has come in the form of all aspects of compliance work (a normal mix), but specifically HMRC are targeting any type of repayment claim as well as taxpayers that have utilised the Coronavirus Job Retention Scheme (CJRS).

Indeed in October and November around 25% of all claims were in respect of the CJRS. From this point of view letters will typically put the onus on the taxpayer to demonstrate that their claim was credible. So letters confirm that HMRC believe the taxpayer needs to repay some or all of a CJRS grant received, as they may have claimed for more grant than they are entitled or not met the conditions for the grant (e.g. by including employees who are not eligible). Taxpayers are given the opportunity to voluntarily make a repayment, without penalty.

Where HMRC undertakes such checks and it is necessary for you to be involved, the enquiry is covered by the Policy subject to the normal terms and conditions and we will of course continue to monitor HMRC’s approach to this in order to ensure that our Policy provides adequate protection for your clients.

Undoubtedly this surge in HMRC activity will continue to increase in the coming months and against this back drop the protection afforded by Tax Fee Protection Insurance, at a relatively modest premium, will have more value in 2021 than ever before.

[contact-block]Related News Articles

Advanced Notification – to opt in, or not to opt in, THAT is the question?

First, let’s recap on the rules. If a client wants to make a claim for Research and Development (R&D) tax relief or expenditure credit for accounting periods beginning on or after 1 April 2023, we need to submit a claim notification form if: The client is claiming for the first time; or The last claim…

Pre-trading and Pre-incorporation Expenditure

Pre-Trading Expenditure The scope of pre-trading expenditure for sole traders is covered in s57 Income Tax (Trading and Other Income) Act 2005 (“ITTOIA05”) and s61 of the Corporation Tax Act 2009 (“CTA09”) for companies. The legislation is applicable to revenue expenditure which is incurred by a trader 7 years prior to the commencement of trade.…

The New Foreign Income and Gains Regime

The old Non-UK Domicile rules are coming to a welcome end on 5th April 2025. The replacement regime focuses on those that have settled in the UK and become Long-Term Resident. From 6 April 2025 the new 4 year foreign income and gains (“FIG”) regime applies to individuals who become UK tax resident after having…